Brand Loyalty Is Dying. Client Loyalty Isn’t.

Ownership shifts test brand loyalty. Do a 24‑month fit check so client loyalty—not platform inertia—drives your decisions.

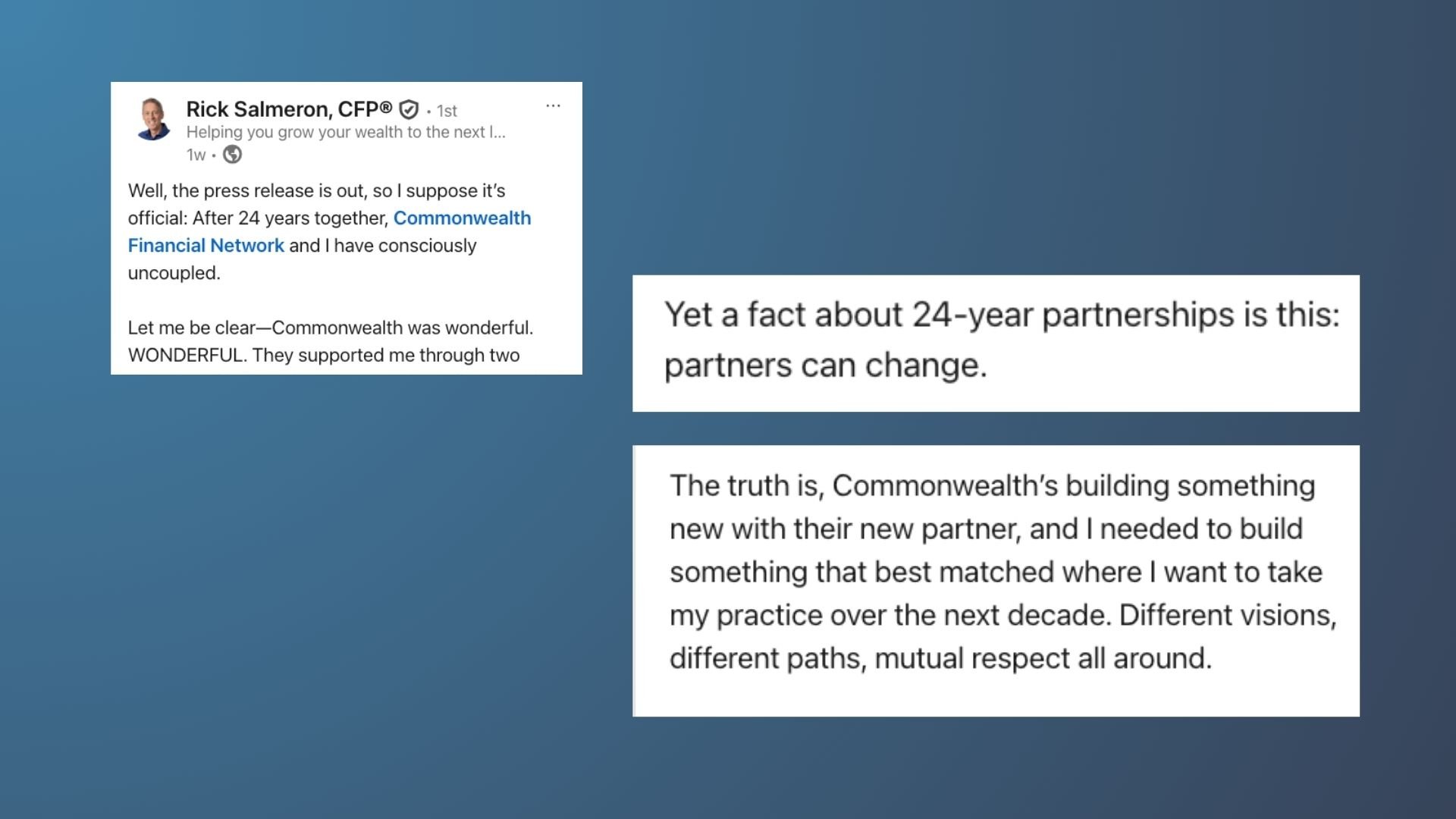

I came across a LinkedIn post by advisor Rick Salmeron, who was announcing his departure from Commonwealth after 24 years in the wake of the LPL acquisition. I thought it was worth sharing because it is one of the more articulate and gracious examples of how advisors are feeling at Commonwealth and at corporate broker-dealers and wirehouses across the industry.

Rick kindly gave his blessing to share the post–here are some of the more poignant segments from it:

“...a fact about 24-year partnerships is this: partners can change.“

“Commonwealth decided to be acquired, which is absolutely their right and probably their best move.”

“The truth is, Commonwealth’s building something new with their new partner, and I needed to build something that best matched where I want to take my practice over the next decade. Different visions, different paths, mutual respect all around.”

I hear this from advisors all over the industry, from Commonwealth to LPL to Edward Jones. Advisors who have been brand-loyal to their firms for 10-20 years are starting to rethink their loyalty en masse as these firms' strategic objectives change in broad daylight.

They still claim to be dedicated to the advisors who built their success, but the symptoms of insufficient re-investment and advisor experience are mounting a case that is hard to overlook.

It's why, in the recruiting world, we've seen an absolute cash grab by every firm targeting Commonwealth's advisors as their experience changes in real time. Those who are leaving frequently seem to represent top-performing leaders.

Advisors are re-assessing fits

The good news is that these advisors also are waking up to the fact that their clients are loyal to the advisor more than they are to the brand. It also follows that they have somewhat of an obligation to consistently reassess what platform represents the best experience for their team and their clients.

I encourage advisors to do a routine reassess every 24 months. This certainly doesn't mean you move every two years, but it gives you a much better pulse on what is evolving in the industry and what norms are being outgrown by newer and better platforms. It's arguably the best antidote to the frog in boiling water analogy.

Questions to ask yourself (and your team)

Service reality: What’s the actual response time your team sees this month?

Tech reliability: Has the core client portal/OMS been stable for your biggest client moments?

Control: Do OSJ/hybrid policies or ownership changes limit choices you assumed you had?

Economics: Put your current net next to two external nets—no pressure to move; just confirm you’re not missing something better.

Create a process to ensure reassessments happen

The advisors I see moving with the highest leverage have more than just successful businesses; they have also created processes for re-assessing the industry landscape. Here is my recommendation from their best practices.

Schedule an audit every 2 years: 60 minutes with your leadership team, a single page of notes, and one outside conversation to sanity‑check your conclusions. If nothing beats your status quo, you’ve still gained conviction. If something does, you’ll see it before urgency forces a rushed decision.

Client loyalty endures when advisor fit is healthy. Brands evolve; your duty to clients doesn’t. Pick your head up. Every two years. Here to give you a process and guidance to explore what exists beyond your platform.

Click here if you want to schedule a confidential, complimentary call.